Planned Giving

“Planned Giving” is the process of making a significant charitable gift during a donor’s life or at death that is part of his or her financial or estate plan.

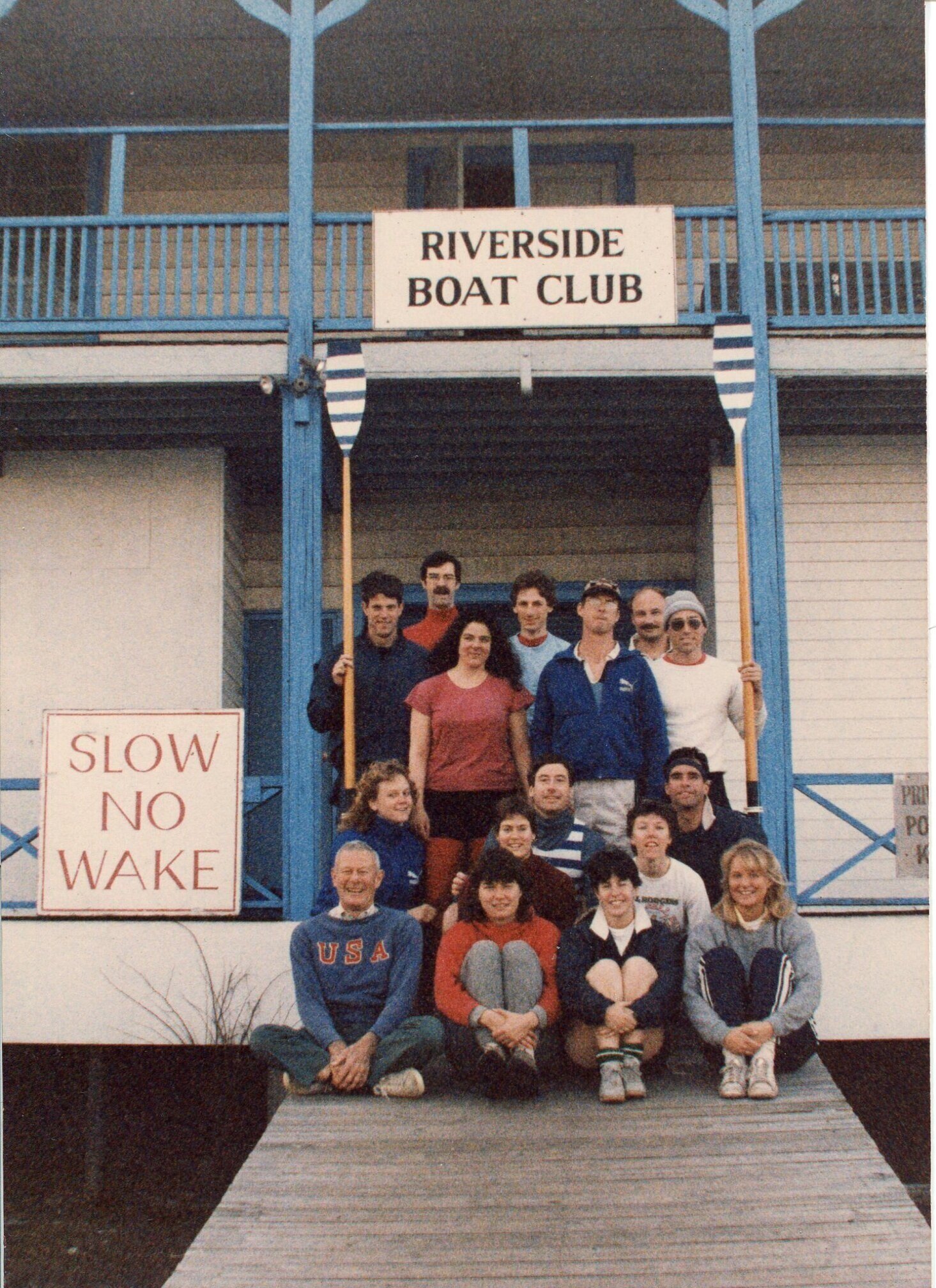

Riverside is grateful for the special community of supporters who have included our Boat Club in their wills or other estate plans; established life income gifts; or named Riverside as a beneficiary of a retirement plan, donor advised fund, insurance policy, or investment account. Their gifts may vary in form and size, but these friends of Riverside share a commitment to strengthen our endowment; fund new initiatives; provide vital support to area of greatest need; and ensure Riverside’s future, while honoring the Club’s past.

For many donors, the most realistic way to make a significant gift to Riverside is through their estates.

You may provide for Riverside Boat Club in many ways, including:

a codicil to your will

an amendment to your revocable trust

a retirement plan beneficiary designation

naming Riverside the beneficiary of your life insurance plan

a donor advised fund or private foundation succession plan

Estate plans should be prepared by and with the advice of an attorney to ensure that your intentions are carried out.

Sample Bequest Language

A general bequest, unrestricted as to purpose:

“I give (____ dollars) or (____ percent of my estate) to Riverside Boat Club, a Massachusetts charitable corporation, for the benefit of [Riverside’s Endowment] [Riverside’s Annual Fund] for its general purposes.”

An endowment bequest for a specific purpose:

“I give (____ dollars) or (____ percent of my estate) to Riverside Boat Club, a Massachusetts charitable corporation, for the benefit of [Riverside’s Endowment] [Riverside’s Annual Fund] [Riverside’s Facilities Fund] [Riverside’s Worlds Athletes Fund], the income to be used for (state the purpose). If, in the future, in the opinion of Riverside Boat Club, all or part of the income of this fund cannot be usefully applied to the above purpose (or in the above manner), it may be used for any purpose within the powers of Riverside Boat Club that will most nearly accomplish my wishes and purposes.”

Giving Through Retirement Plans

Designating Riverside as a beneficiary of your retirement plan is an especially tax-wise way to support the Boat Club or other programs. Riverside receives all or a part of the plan assets in full, undiminished by estate and gift taxes.

Retirement accounts can be the most highly taxed assets many people hold, as they may be subject to both income tax when distributed as well as estate taxes. In a large estate, these taxes can leave less than 30 cents on the dollar of these plans for your children or other heirs.

By naming Riverside as the beneficiary of your retirement plan, the full amount of your legacy gift is available for a designation that you specify such as the endowment, a specific fund, or unrestricted funds that provide flexible support.

You can designate Riverside Boat Club as a beneficiary of part or all the remainder of your IRA or retirement plan.

How it Works

Request a beneficiary designation form from your plan’s administrator. Many plans permit you to make the change directly online.

Complete the (printed or online) form using any of the following suggested language:

Riverside Boat Club, for the benefit of Riverside Boat Club

Riverside Boat Club FBO Riverside BC

Any individual who is 70 ½ or older can transfer tax-free gifts (maximum $100,000 each year) directly from their IRA to Riverside using the IRA Charitable Rollover.

Legal Name

All charitable gifts should be directed to “Riverside Boat Club”

Taxpayer Identification Number (TIN)

04-2664080